Oct. 28, 2025

Contact: Brian Consiglio, consigliob@missouri.edu

Photo by Abbie Lankitus

The Fall 2025 Missouri Farm Income Outlook forecasts an increase in net farm income, largely due to a boost in livestock receipts and government payments, according to the Rural and Farm Finance Policy Analysis Center (RaFF) at the University of Missouri.

Published twice a year, the report provides statewide projections of major farm financial indicators for Missouri, analyzing cash receipts, production data, government payments and other factors to estimate the state's net farm income. Missouri’s net farm income is projected at $5.39 billion in 2025, a 58% increase from 2024.

Other highlights from the Fall 2025 report include:

- Missouri’s projected 58% increase in net farm income is substantially higher than the projected 41% increase in U.S. net farm income for 2025.

- Total crop receipts are projected to decline slightly (-1%) to $6.74 billion, as increases in corn receipts would slightly offset reductions in all other major crops. In Missouri, soybean receipts account for 41% of all crop receipts and corn receipts account for 39% in 2025.

- Livestock receipts will increase by 17% to $8.03 billion in 2025. This is mainly driven by a 21% increase in cattle receipts, due to higher cattle prices. Cattle account for 50% of total livestock receipts, hogs account for 16% and broilers for 14% in Missouri in 2025.

- Total production expenses remain stable, as a $162.06 million (-9%) decline in feed costs would offset the $143.92 million (18%) increase in purchased livestock expenses. Declines in interest, net rent to landlords, and hire and custom machinery work help stabilize costs.

Looking ahead, the report projects Missouri net farm income will decrease in 2026 by 16%, as direct government payments return to average levels observed between 2018 and 2024. Cash receipts are expected to decline slightly for both crops and livestock. Production expenses are forecast to remain stable.

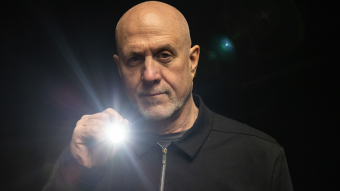

“While many producers are awaiting government payments from the Agriculture Risk Coverage and Price Loss Coverage programs as well as from emergency and disaster relief programs, the outlook for the disbursement of that money is unknown,” Alejandro Plastina, director of RaFF, said. “Many factors are combining to make profitability in agricultural production challenging, particularly for crops. When planning for 2026, farmers and ranchers should take action to secure sufficient liquidity to operate under sustained tight margins, barring unanticipated new government payments or pent-up demand for agricultural commodities.”

University of Missouri Extension offers valuable support through publications, tools and workshops to inform decision-making. For more information, visit muext.us/AgBusiness.

Missouri’s Farm Income Outlook is one of 10 state-level farm income reports produced by RaFF in collaboration with land-grant institutions in states such as Arkansas, Kansas and Nebraska, offering additional coverage of key Midwestern and Southern regions.

The full report and supporting tables are available for download at raff.missouri.edu/farm-income.