Published on Show Me Mizzou Aug. 27, 2024

Story by Dale Smith, BJ ’88

If there’s an angsty topic troubling the sleep of adults of all ages, it’s the question of how best to invest for retirement. The received wisdom advises younger people to invest in stocks, which can be volatile but lucrative, and for older people to sock money into bonds, which guarantee known but modest payouts. Institutions — even federal laws — have enshrined this as the standard life cycle of investing.

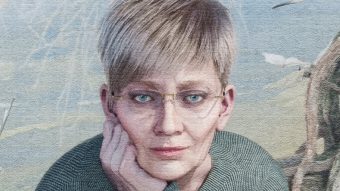

Then finance Professor Michael Doherty and big data came along to test that theory. Doherty ran millions of life-cycle investing simulations on four approaches using financial information going back a century or more across 38 countries. He wanted to find out how to achieve the most wealth at retirement, income during retirement and money remaining at death.

Rating the four investing approaches, a bonds-only strategy fared worst, not surprisingly. Coming in third, and much tougher to swallow, was the standard stocks early and bonds late approach. (But don’t dump your 401(k) just yet, Doherty says.) Placing second was a portfolio of domestic stocks. Besting them all was a 50-50 split of domestic and international stocks. Investors with standard life-cycle portfolios would have had to invest 40 percent more to match it.

The domestic-international approach held up even during economic downturns, such as the Great Recession of 2007–2009. Why stay the course under these circumstances? “Big negative returns in stocks also tend to be negative in bonds,” Doherty says. “Plus, the wealth creation we get from stocks makes up for losses. It works out.”

Doherty thinks it’d be rash to fashion weighty financial recommendations from a single study and its new model. “After all,” he quips, “simulated investors can always sleep at night.”

To read more articles like this, become a Mizzou Alumni Association member and receive MIZZOU magazine in your mailbox. Click here to join.