Fred Bereskin, Sudip Datta, Jialu Shen and Michael Young

July 31, 2024

University of Missouri faculty in the Robert J. Trulaske, Sr. College of Business Finance Department are examining relevant issues in today's world of finance through data-driven, unbiased research that is informing and influencing today’s businesses and policymakers.

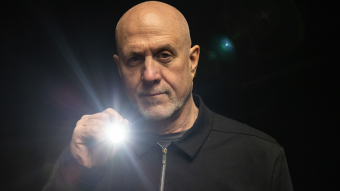

Fred Bereskin

Research from Fred Bereskin, associate professor of finance and Richard G. Miller Professor of Finance, found investing in an alleged patent infringer might just pay off.

Using patent lawsuit data from 2000 to 2014, Bereskin and fellow researchers Po-Hsuan Hsu, William Latham and Huijun Wang found a stock portfolio consisting of alleged patent infringers provided significantly higher stock returns – between .048% to .61% per month – in the following year than other firms with similar characteristics. In contrast, plaintiff firms’ subsequent stock returns were not significantly different from comparable firms’ returns.

Bereskin said investigating the outcomes of patent infringement and associated litigation is important because the number of such cases has increased dramatically since the 1980s.

Sudip Datta

When a privately-held company offers shares to the public for the first time – a process called Initial Public Offering or IPO – potential investors are looking for indications that the soon-to-be publicly-traded company is healthy and worth the backing.

One well-established clue is the strength of the underwriter involved in the process. But a recent study by a team of researchers including Sudip Datta, chair of the Finance Department and professor of finance, found that the reputation of the auditor has a significant impact on long-run, post IPO stock price performance. The findings hold practical implications for firms considering going public, underscoring the importance of an auditor’s reputation in the IPO process and how that can impact the long-term value of the stock.

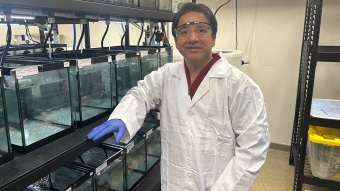

Jialu Shen

While reverse mortgages sound like a reasonable solution for older homeowners, research from Jialu Shen, an assistant professor of finance, has found that the benefits of these loans don’t stop with the older recipients. The research demonstrates that the inclusion of reverse mortgages has a significant impact on housing prices, making the market more competitive and homeownership more appealing.

Shen also found that older homeowners who opt for reverse mortgages experience enhanced “consumption smoothing” – or a balance between spending and saving – compared to those who do not participate. She added that people are living longer and facing more socioeconomic disparities, adding to the need for options like reverse mortgages.

Michael Young

According to an ongoing study by Michael Young, an assistant professor of finance, anonymously managed mutual funds significantly underperformed – by about 1% a year – when compared to funds whose managers were named.

Using a global sample of mutual funds, researchers found that 17% of funds worldwide – excluding the U.S. – and 22% of emerging markets funds do not disclose the names of their management team. These anonymously managed funds were also found to be less active with some managers shirking their duties and doing little more than roughly tracking and indexing. In general, unnamed managers avoided competing or taking risks to improve their performance.

Read more from the Robert J. Trulaske, Sr. College of Business