April 9, 2020

Contact: Austin Fitzgerald, 573-882-6217, fitzgeraldac@missouri.edu

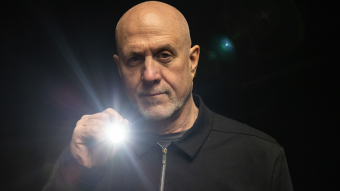

As COVID-19 continues to spread in the United States, the agricultural industry is facing challenges related to demand, the workforce and widespread uncertainty. Here, Scott Brown — an associate extension professor of agricultural and applied economics at the University of Missouri's College of Agriculture, Food and Natural Resources — answers a few common questions about how the agricultural economy is doing amidst the COVID-19 outbreak.

How is the agricultural economy in the U.S. faring during this crisis? Are farmers taking a hit?

U.S. farmers are finding many challenges due to the COVID-19 outbreak. There is considerable uncertainty around corn and soybean crops, which are being planted in increased numbers after last year’s flooding and wet weather disrupted the crops. Corn-based ethanol, for instance, continues to suffer as crude oil prices have remained below $25 a barrel. The rock-bottom oil prices are due, at least in part, to the economic downturn resulting from the global COVID-19 outbreak. Many ethanol plants are now idled as turning corn into fuel is not financially profitable.

Livestock farmers have also seen markets turn considerably lower with the outbreak of COVID-19. Futures prices for live cattle (25% lower), hogs (35% lower) and milk (20% lower) have all moved down over the past two months. This has strained livestock producers to figure out how to find markets for their products. In some cases, milk producers have been forced to dump milk because there is simply no room for it at processing plants.

Grocery store shelves have been emptied in some cases, and yet farmers are not able to secure a market for their products. What is the problem?

The loss of the food-service industry has created a dramatic decline in the demand for agricultural products. At the same time, consumers are stocking up on grocery store purchases to cope with the COVID-19 outbreak. The USDA estimated that food-at-home purchases by consumers totaled $781 billion in 2018 while food-away-from-home purchases totaled $931 billion — that ratio looks a lot more lopsided right now. It has been a monumental task to change an infrastructure designed to provide a significant percentage of products for the food-service industry to now increase product flow to groceries. COVID-19 challenges have also directly affected agricultural processing facilities that have had to shutter for periods of time as their workers test positive for COVID-19. Processing speeds have also slowed as companies practice social distancing measures in these facilities.

Changing from a food service demand driven market to a grocery demand driven market has dramatically altered prices. Wholesale pork belly prices (bacon) have tumbled from $0.90 per pound in mid-March to nearly $0.30 per pound by early April. Cheese, butter, ribs and chicken wings have also seen significant price declines as they tend to be primarily consumed away from home. On the other hand, pork loin — popular with grocery shoppers — has jumped from $0.75 per pound in mid-March to $1.00 per pound by early April fueled by grocery demand.

Will there be lasting impacts from this crisis?

There will likely be long-term impacts on agriculture from the COVID-19 outbreak. Some farmers, processors, distributors and others will be forced to exit the industry as a result of the severe economic situation they face today. It is too early to know exactly how much change will unfold, as it depends on how quickly recovery can begin once the U.S. relaxes current measures to combat the COVID-19 outbreak.

There is hope, however. The phase one trade agreement signed with China before COVID-19 began to dominate world headlines may soon give U.S. farmers stronger and much-needed demand for their products. As the Chinese economy begins the recovery process and works to fulfill trade commitments made under the phase one agreement, demand will rise accordingly. Before the COVID-19 crisis unfolded, international demand for U.S. agricultural products started the year strong with U.S. pork exports up more than 40% above year ago levels in February of this year.

What government programs are available to help agriculture survive the economic downturn associated with the COVID-19 outbreak?

The U.S. Congress included funding in the third round of stimulus (CARES Act) to support agriculture. Specifically, $9.5 billion was available to assist specialty crop producers; producers who support local food systems such as farmers markets, schools, and restaurants; and livestock producers, including dairy. The USDA is currently working on programs to implement this new funding and have looked to industry to provide ideas for new programs.

There is reason to believe that once we relax the current measures put in place to combat COVID-19, agriculture could see a much-improved economic picture. Refilling food-service pipelines as restaurants reopen could push prices for many agricultural commodities higher later in 2020. At this point, it remains important to help agriculture survive the current economic downturn until recovery can begin.