Published on Show Me Mizzou Jan. 10, 2024

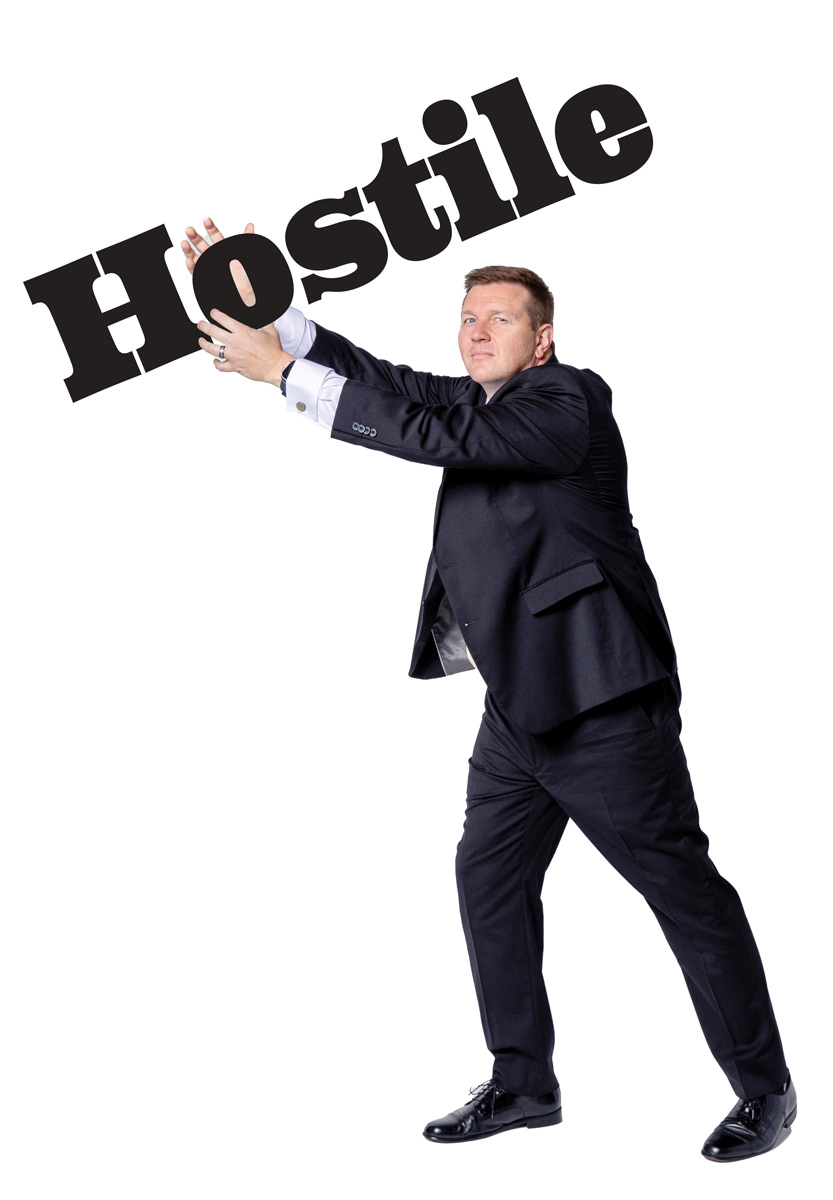

Elon Musk’s hostile takeover of Twitter (now X) is the most recent high-profile example of the perennial strong-arm tactic, but it’s not new. “In the 1970s and ’80s, established managers may have had control of their company on a Friday, but there’d be a takeover that put in a whole new management team by Monday,” says Associate Professor Adam Yore, the Stephen Furbacher Professor of Organizational Change. Wall Street investors made money in the short run, he notes, but workers and managers were unlikely to fare as well. And so, one by one during the ’80s and ’90s, states responded by putting antitakeover provisions on the books.

Yore’s forthcoming study in the Journal of Financial and Quantitative Analysis considers whether antitakeover provisions deserve the dominant opinion — that they decrease firm value and unfairly shield underperforming managers — or whether they supply a needed check on rapacious capitalism.

As a proxy for a firm’s overall value, Yore plotted the monetary value shareholders placed on the line item in a balance sheet most susceptible to waste — excess cash reserves, or slack. Investors dislike slack. Shareholders generally valued an extra dollar of cash at 62 cents. “That increases by about 24 cents after states enact antitakeover laws,” he says.

But there’s a twist. The increase accrues only to companies whose customers prize stability in management, including firms with a major industrial customer, Yore says. Antitakeover provisions reassure such customers that agreements, whether written or unwritten, will be honored because the vendor’s managers are likely to remain in place.

That picture changes in industries where a scarcity of rivals reduces competition. Managers with a stable customer base and little fear of hostile takeover tend to feel overly secure in their jobs, Yore says. That can be a negative because protecting job security can foster an excess of caution and dearth of effort, leading to a firm that misses chances to make money.

To read more articles like this, become a Mizzou Alumni Association member and receive MIZZOU magazine in your mailbox. Click here to join.